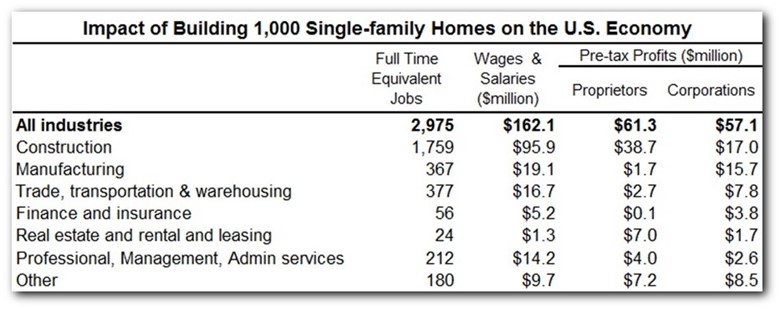

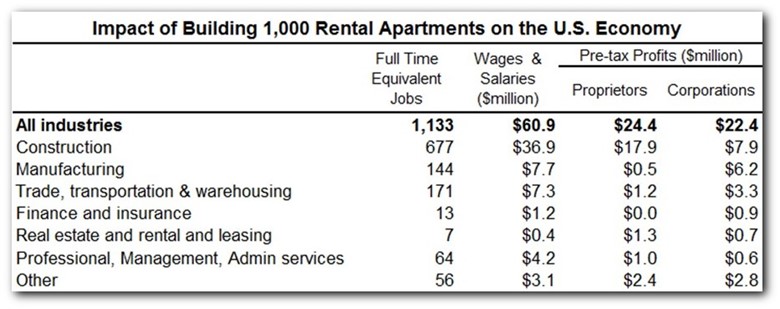

According to NAHB’s National Impact of Home Building model, building 1,000 average single-family homes generates 2,975 jobs and $111.0 million in taxes and fees for all levels of government. Similarly, building 1,000 average rental apartments generates 1,133 jobs and $42.4 million in taxes.

The jobs are measured in full-time equivalents (enough work to keep one worker employed full-time for a year), and are broad-based. Although a substantial share of the employment is generated in the construction industry, other jobs are created for employees in firms that manufacture building products, transport and sell those products, and provide professional services to home builders and buyers (e.g., architects and real estate agents). A breakdown by industry is shown below, along with the wages and business profits generated.

Wages, profits and the construction activity itself are subject to a variety of taxes and fees that generate revenue for the approximately 90,000 different governments in the U.S. The $111.0 million in taxes and fees generated by 1,000 single-family home includes $74.4 million in federal taxes (mostly income taxes and Social Security), $10.3 million in state and local income taxes, $6.9 million in state and local sales taxes, and $13.7 million in impact, permit and other fees local governments impose on new construction.

Similarly, the $42.4 million in taxes and fees generated by 1,000 rental apartments includes $28.4 million in federal taxes, $3.9 million in state and local income taxes, $2.6 million in state and local sales taxes, and $5.4 million in permit and other construction-related fees collected by local governments. These fees are part of the government regulation that in total accounts for 24.3 percent of the price of a new home.